Our advice on superannuation for mining and resources professionals is this: Do what you can, as early as you can, to take advantage of the tax-efficient savings environment that the Australian super system offers.

Your decisions around super are all the more important since 1 July 2017 as the lowered concessional contributions cap may have implications for your super strategy.

The superannuation concessional contributions cap has reduced to $25,000 per financial year. This is much lower than previously and may have implications for high-income individuals, including those in mining and resources. Concessional contributions include employer Superannuation Guarantee (SG) contributions and salary sacrifice contributions as well as tax deductible contributions for self-employed persons.

Given the reduced cap, individuals of pre-retirement age may need to consider making additional super contributions earlier than planned in order to be able to afford the retirement lifestyle of your choice.

Salary sacrificing (or making tax deductible contributions) can be an effective strategy for building your super, although it is best to seek individualised professional advice as the strategy may not suit everybody. Salary sacrificing redirects some of your pre-tax income into super where contributions are taxed by the super fund at 15% (the same rate as your employer’s contributions), which is likely to be lower than your marginal tax rate. Note that if your income is above $250,000 pa, you may be subject to an additional 15% contributions tax.

Starting salary sacrificing early and maintaining it throughout your working life may help build your super balance for your retirement. It may also help you make more tax-effective use of your surplus cashflow.

Watch our short video on salary sacrifice.

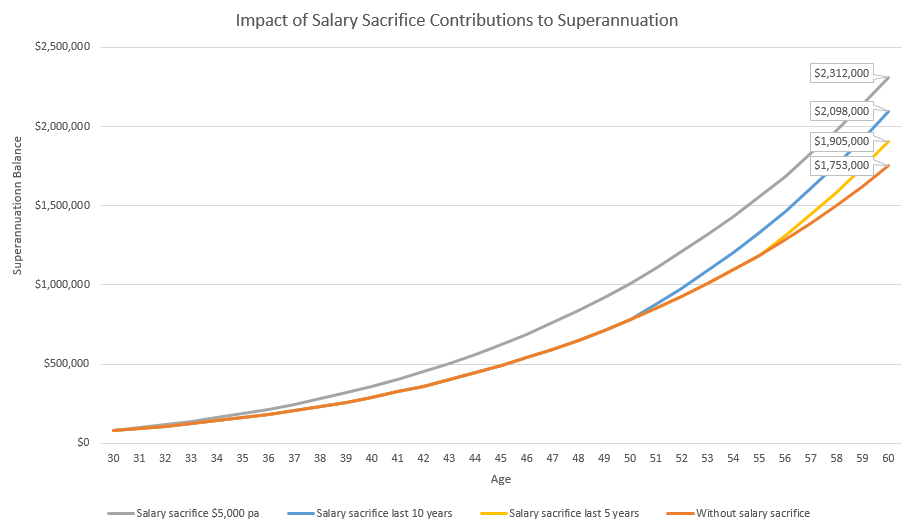

Here’s an example of how a young mining professional can use salary sacrificing to accumulate super for their retirement. Importantly, this strategy addresses the fact that it will no longer be possible for an individual to boost their super savings through salary sacrificing significant sums from their salaries in the decade before their retirement.

Jane is a young resources professional, with an annual salary of $100,000. With a good income and few financial responsibilities, Jane comfortably salary sacrifices $5,000 pa to superannuation.

Let’s compare this to a situation where Jane doesn’t make any salary sacrifice contributions to superannuation until 5 or 10 years prior to her retirement at age 60, at which point she decides to maximise the level of tax effective contributions she can make to superannuation each year. This scenario is commonly seen where personal cashflow is used to meet mortgage repayments, school fees and other personal expenses, which generally reduce closer to retirement, allowing for more savings. We have also included a scenario where Jane is fully reliant on the superannuation guarantee contributions from her employer, and makes no salary sacrifice contributions to superannuation.

Assumptions:

- Jane is 30 years of age

- Super balance at commencement $80,000

- Jane receives superannuation guarantee contributions from her employer

- Jane’s salary is indexed by 4% pa

- Jane salary sacrifices $5,000 pa to superannuation, indexed 4% pa

- The net total return in superannuation is 7.40% pa

- The concessional contributions cap and division 293 tax* income threshold are indexed in future years

Outcome:

- Compounded over 30 years or more, the above demonstrates that starting regular contributions to superannuation early, can amount to a very effective savings strategy. Even where Jane seeks to maximise her tax effective contributions in the 10 years prior to her retirement, she would have been better off by more than $200,000 if she had started making smaller, regular contributions to superannuation early.

- Over the life of this projection Jane contributes by salary sacrifice an additional;

- $5,000 pa $280,426

- last 5 years $179,232

- last 10 years $324,318

Disclaimer: The above projection is for comparison purposes only and is not a guarantee. The projection is not intended to be your sole source of information when making a financial decision. You should consider whether you should seek advice from a licensed financial adviser before making any decision about salary sacrifice contributions to superannuation.

The dilemma

Many Australians expect or even rely on being able to increase their super contributions later in their working life, once the mortgage is under control or in the final years of children’s schooling. Their aim is to boost their super balance in the ten or so years before they retire. This may seem a sound plan, but the limits to make tax-effective super contributions may restrict their ability to do so. As can be seen in the preceding illustration leaving contributions to then not only limits how much you can contribute to super, it may also limit how you much you accumulate in super.

Other considerations

Liquidity needs

While making additional concessional contributions may help you retire with more super, it’s important to consider whether you may require access to the money before you meet a ‘condition of release’.

Division 293 tax*

Division 293 tax was introduced from the 2012/13 financial year to reduce the tax concession on superannuation contributions for individuals with an annual income of more than $300,000. Since 1 July 2017, the Division 293 income threshold has been $250,000.

Although making concessional contributions up to the cap continues to be a tax-effective strategy, as a high-income earner, an additional 15% on concessional contributions will be imposed by Division 293. This is in addition to the 15% tax payable by taxed funds on concessional contributions, making total contributions tax of 30%.

Making concessional contributions can generally still be more favourable when compared to the highest marginal tax rate of 47% for high income clients for two reasons:

- Concessional contributions are taxed at a maximum of 30%

- Earnings on capital invested in super are taxed at a maximum of 15%

In summary

We recommend that you seek advice on how you may benefit from salary sacrificing as a means of making concessional contributions in the reduced cap environment. Please contact us to talk about how we can help by phoning (07) 3007 2007 or emailing bcribb@stratusfinancialgroup.com.au or jmarshall@stratusfinancialgroup.com.au

Resources Unearthed is a solutions hub that provides integrated financial, business and legal services for executives, professionals and business owners in the mining and resources sectors.

Stratus Financial Group and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. This information does not consider your personal circumstances and is of a general nature only. You should not act on it without first obtaining professional financial advice specific to your circumstances.